Rule of thumbs are a great starting point to make a good decisions, going based on what you want and think based on your experience is usually a terrible idea, because your ideas tend to come from marketing, and most people don’t think about affording a car based on price of the car but instead on monthly payments of the car

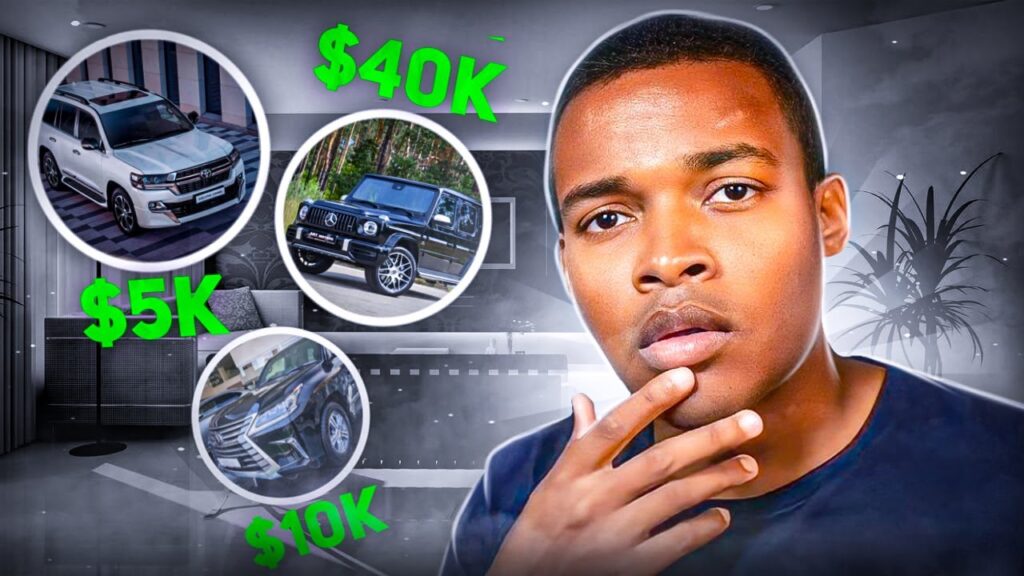

So in this video, I’ll talking about 3 methods to buy a car, and not make a crazy bad mistake but the last one is the one that I would use and the most common sense idea.

????Call Me????: https://bit.ly/30IBr0i

????Second Channel????: https://bit.ly/3c4sVPS

????????????Financial Freedom Course????????????$100 OFF CODE: LONGTERM

Link: https://longtermteam.teachable.com/p/financial-freedom-steps-from-nothing-to-freedom

????MY M1 FINANCE PORTFOLIO???? PLUS $10

Link: https://m1.finance/37SHd4241z-N

Marko – whiteboard

20% down

4 year car loan

10% limit of of monthly income

People are Wrong:

They say I cant afford to pay cash for a car

The real answer is the car I want, I cant afford it with cash

You liteally have cars under $1000, that can keep running long enouhg for you to be able to buy a nicer car

Here is this crazy math: $16,000 car is what you can afford if you make $3000 bucks per month

If you put down 20% that’s $3,200

If you take 4 years to pay it off, your monhtly bill is 299.38 at a 5% rate

And its less than 10% of your income

However:

This doesn’t include maintence

Doesn’t include insurance

And to be honest, for $3200 you can buy a decent car

Dave Ramsey

He has a simple rule

You shouldn’t spend more than half your annual income on a car

And you should pay cash for it

For example: if you make 3k per month, that’s 36k a year

So your budget is $18,000 which is 2k more than before

But the cash is, you have to save up to pay cash for it

But the good thing is, you don’t have to max out your budget anyways

The con:

Its the waiting people don’t like

3. Common Sense

– buy the car you can afford to pay for in cash and not stay broke

– this basically means you should still have money for a quick emergency, doesn’t have to be full emergency accoutn but atleast $500-$1000 just in case

– this is a rule for all the cars you buy, its really that simple

But here are Some buts:

One: if you have a bunch of debt, don’t waste years savings, instead save for a few month and buy a cheap car to allow you to payoff your debt

The point is the only time you can take a long time to save for a nice car, is when you covered all your priorities

Being debt free, savings for a full emergency account and also paying off a home

Tips:

Obviously this takes years

So its important the cars you buy are based on reliability and not based on want

The want comes later

If it takes you 15 years to the priorities you’ll probably cycle 2-3 reliable cars but if you go for luxury brands and speed cars, good luck

What car would I buy for $3200

Toyota Corollas, camry, yaris

Hunda Civic or fit

Bsaically nothing I like lol

* PRO TIP*

INFORMATION IS EVERYTHING

????1 on 1 Talk + My Budget + Stock Investments????

https://www.patreon.com/tommybryson

????Merch????

https://teespring.com/stores/tommybryson

✅2 FREE AUDIOBOOKS✅

https://amzn.to/2Enayo8¬¬¬

????M1 FINANCE $10????

https://m1.finance/37SHd4241z-N

????ACORN FREE $5????

Link: https://acorns.com/invite/38EYSU

⚡FREE KINDLE UNLIMITED⚡ (traditional reading)

Link: https://amzn.to/2VGbxt9

????????????DISCORD PRIVATE GROUP????????????

https://discord.gg/EcZEHpA

My Camera Gear: https://www.amazon.com/shop/tommybryson

✔ Help Us Reach 500,000 Subscribers: https://goo.gl/0wvm6w

????All My Social Media????

Link: https://linktr.ee/tommybryson

*Some of the links and other products that appear on this video are from companies in which Tommy Bryson will earn an affiliate commission or referral bonus. Tommy Bryson is part of an affiliate network and receives compensation for sending traffic to partner sites. The content in this video is accurate as of the posting date. Some of the offers mentioned may no longer be available. I’m an Accountant but I’m not your Accountant, always review information with your Accountant/CPA and your Financial Advisor.

source